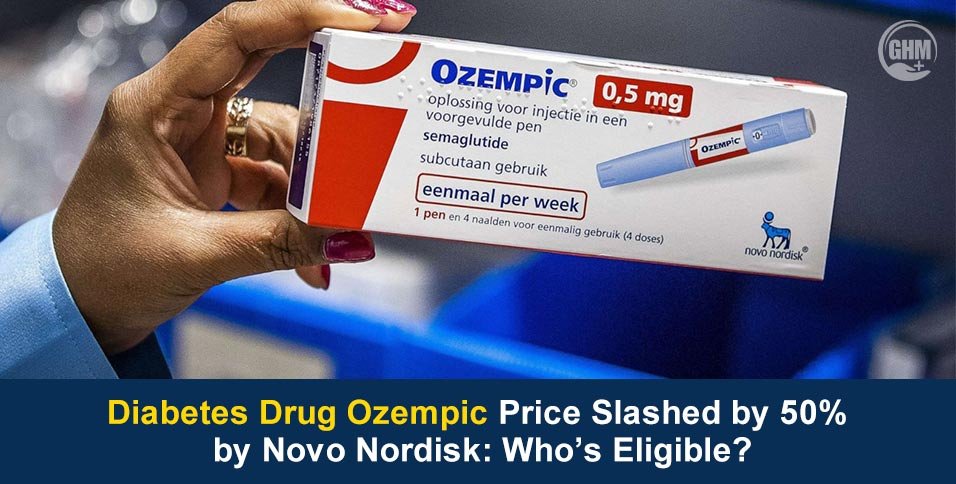

The Diabetes Drug Ozempic has suddenly moved to the center of America’s healthcare conversation—and not because of a breakthrough in clinical data. In an unexpected move that immediately sent shockwaves across the pharmaceutical market, Novo Nordisk announced that it is slicing the U.S. list price of Ozempic by nearly 50%, bringing the monthly cost for uninsured patients down from close to $1,000 to $499. In a healthcare climate where affordability remains one of the biggest concerns for patients and policymakers, this decision is being closely watched far beyond the diabetes community.

What Exactly Has Changed?

Effective August 2025, Novo Nordisk has implemented a permanent price reduction for Ozempic in the United States. This drop applies specifically to cash-paying patients—those without insurance coverage or those whose plans exclude Ozempic from their reimbursement lists.

Through partnerships with GoodRx, and the company’s own NovoCare program, eligible patients can now access all available dose sizes of Ozempic at $499 per month at more than 70,000 pharmacies nationwide. Importantly, this reduced price is processed outside of any insurance, which means it does not count toward deductibles or annual out-of-pocket limits.

Who Stands to Benefit?

While the headline number is dramatic, it’s crucial to understand who exactly benefits from this change.

- Uninsured/self-paying patients: These are the primary beneficiaries. Until now, they were paying the full list price — often more than $12,000 per year.

- Underinsured patients: Those with high-deductible plans or no prescription drug coverage will also gain immediate relief.

For most insured patients, however, the price drop brings little to no change. Many already pay far less — sometimes as little as $25 per month — due to copay structures, rebate agreements, and patient assistance programs.

Why Did Novo Nordisk Slash the Price?

There are several major forces driving this unprecedented decision:

Political Pressure Is Intensifying:

With rising concern in Washington over high drug prices, GLP-1 class medications like Ozempic have become a focal point for lawmakers. Novo Nordisk’s move follows a wave of public pressure and recent comments from the Trump administration emphasizing the need to lower pricing on essential medicines.

Competitive Heat from Eli Lilly:

Novo Nordisk is not alone in the GLP-1 market. Eli Lilly has already cut prices on its competing diabetes drugs. In order to remain competitive and protect its market share, Novo Nordisk needed a bold, public response.

A Rise in Unsafe Compounded Versions:

A growing number of patients had started turning to unregulated or compounded forms of semaglutide due to high prices. The lower price is designed to draw patients back to the FDA-approved product by reducing the financial hurdle.

Corporate Image and Market Expansion:

Lowering the price helps Novo Nordisk strengthen its corporate image, improve accessibility, and potentially expand its user base among patients who previously couldn’t afford Ozempic.

What Does This Mean for Insured Patients?

It is important to clarify that the price change does not alter insurance coverage. Insured patients:

- Will not see a change in their copay or deductible requirements.

- Cannot apply the $499 cash price to their insurance because it is processed outside of the plan structure.

- Will continue to use their plan as usual unless they choose to bypass insurance entirely and pay cash.

In short, the structural cost of Ozempic for insured patients remains largely the same.

Growing Opportunities — and Questions — in the GLP-1 Market

The GLP-1 market has been expanding at a record pace, driven by demand for both diabetes management and weight-loss applications. Even Wegovy, Novo Nordisk’s weight-loss drug using the same active ingredient (semaglutide), has been included in the new $499 cash offer.

Analysts see this as part of a broader strategy to sustain long-term brand loyalty in a market that is attracting competitors as well as generic and compounded alternatives. It also raises several key questions:

- Will other manufacturers now follow suit and reduce their prices?

- Could this move pressure private insurers to renegotiate reimbursements on GLP-1 drugs?

- Will the increased accessibility result in higher adoption and accelerate overall market growth?

Final Thoughts: A Major Step—But Only for Those Who Qualify

This is one of the most significant pricing changes to hit the U.S. pharmaceutical sector in recent years. For uninsured and underinsured patients, it offers real and immediate financial relief. For others, it is a symbolic—and strategic—step that signals where the broader market may be heading.

One thing is clear: the conversation surrounding the Diabetes Drug Ozempic is no longer just about clinical efficacy. It’s about access, affordability, and the evolving role of pharmaceutical companies in solving one of the greatest health challenges of our time.